| View this email as Webpage |

| |||||||||||||||||||||

To be removed from this list please visit manage subscription to unsubscribe. Media LLC |

| View this email as Webpage |

| |||||||||||||||||||||

To be removed from this list please visit manage subscription to unsubscribe. Media LLC |

The crypto market is as unpredictable as it is exhilarating. Whether you're a seasoned investor or just stepping into this brave new world, understanding its underlying dynamics can mean the difference between striking gold and facing a hard fall. Drawing on over seven years of hands-on experience, this guide distills hard-won lessons into a clear, practical roadmap for success.

In this article, we'll cover:

Let's dive into the insights that can transform your approach to crypto investing.

Before you put a single dollar into crypto, take a hard look at your financial situation and risk appetite. The first step is to understand your personal investor profile. Ask yourself:

A simple cash flow breakdown can be a game changer:

This flowchart helps you visualize the process of assessing your cash flow to decide how much capital you can comfortably risk in the crypto market.

Understanding the cyclical nature of the crypto market is essential. The market typically moves through four distinct phases:

To illustrate, consider this state diagram that maps the journey:

Understanding where the market stands within this cycle helps you make smarter entry and exit decisions. It also clarifies why "holding forever" isn't always the best strategy — sometimes, it's wiser to take profits as the hype peaks.

Tokenomics is the lifeblood of crypto investing. Every token has its own economic model — supply, distribution mechanisms, utility, and demand drivers. Many investors lose money simply because they haven't dug deep enough into these details. For example, projects that reached all-time highs only to plummet in value often did so because investors failed to understand their underlying tokenomics.

Key takeaway:

Study the structure of each token and how it influences its market behavior. Become proficient at analyzing token supply, emission schedules, and demand curves.

Crypto markets are notorious for their emotional swings. Social media buzz and sensational headlines can create a fear of missing out, leading to rash decisions. The advice here is clear: avoid buying the dip with the expectation of an endless drop. Instead, set realistic entry points and stick to a disciplined strategy — even if that means paying a bit more for quality assets when the market is hot.

In the world of crypto, timing is everything. Gaining an edge over the competition means staying ahead of the curve by leveraging social media and specialized tools. Here are some practical tips:

Crypto investing is not just about chasing the next big win — it's about developing a nuanced understanding of a rapidly evolving market. By knowing your financial profile, mastering market cycles, delving deep into tokenomics, and arming yourself with timely information, you set yourself on the path to sustainable success.

What steps will you take today to refine your crypto strategy? Join the conversation — share your thoughts, questions, and experiences in the comments below. Remember, every smart investor was once a curious beginner.

Have you ever experienced that rush when your crypto portfolio hits an all-time high — only to see those gains vanish as quickly as they appeared? In the volatile world of cryptocurrency, it's easy to be seduced by the numbers on the screen. But those dazzling gains can be nothing more than illusions if not managed properly. This article explores the psychological traps and common mistakes many traders fall into, offering seven essential tips to help you safeguard your capital and trade smarter.

Imagine this: your portfolio is ablaze with green, your ATH (All-Time High) shimmers on the screen, and you feel unstoppable. The temptation to capture that moment and share it with friends is overwhelming. However, what you see isn't liquid cash. Once you factor in trading fees, commissions, and taxes, those soaring numbers shrink dramatically. This false sense of security often leads traders to:

Before diving into the top tips, let's visualize the decision-making process that often traps investors.

Below is a chart that captures the essential steps an investor should consider when faced with an ATH scenario:

Your portfolio's ATH is a milestone — not actual cash in hand. Trading fees, withdrawal commissions, and taxes can significantly reduce what appears to be a hefty profit. Accepting this fact is crucial to avoid overconfidence and the subsequent traps it brings.

It's a common misconception to believe that a winning streak will continue at a steady, linear rate. Markets are cyclical; even assets like Bitcoin have experienced sharp 70% corrections within weeks. Adjust your expectations, diversify your investments, and plan for inevitable downturns.

Waiting for that mythical "perfect" exit point is a recipe for disaster. Instead, set clear, predetermined exit points before you even enter a trade. By taking profits periodically, you secure gains and build a robust base for reinvestment — regardless of where the market heads next.

Buying the dip can be enticing — after all, a 20%, 30%, or even 50% drop might seem like an opportunity to scoop up discounted assets. However, a dip might signal the beginning of a deeper decline rather than a temporary setback. Evaluate the token's fundamentals and market context before committing additional capital.

In a bullish market, the lure of rotating tokens to chase even higher returns is strong. Yet, overtrading often results in diminishing returns. Instead of constantly swapping high-performing tokens for lower-cap alternatives, focus on projects with solid fundamentals and take gradual profits.

Revenge trading is an emotionally charged mistake — when losses trigger a desperate desire to "win back" what was lost. This approach leads to riskier bets and can compound your losses. Recognize these emotional triggers, pause, and reassess your strategy rather than rushing back into the fray.

Crypto trading isn't just about numbers — it's a psychological battleground. Developing and adhering to a detailed trading plan that includes entry/exit strategies and risk management protocols is essential. This structure helps mitigate the powerful forces of FOMO, greed, and fear that can otherwise derail your decisions.

The key takeaway is simple: discipline and strategy are paramount in the volatile world of crypto trading. By understanding that the gleaming numbers on your screen are ephemeral, and by taking profits methodically, you pave the way for long-term success. Avoid the pitfalls of waiting for perfection, overtrading, and revenge trading. Instead, take control of your emotions, trust your well-laid strategy, and adapt to shifting market conditions.

What challenges have you faced on your crypto journey? Do you have any additional tips or strategies that have worked for you? Share your thoughts in the comments below — your experience could be the key to helping another trader navigate this complex landscape.

In the fast-evolving world of technology, AI Agents are emerging as the game-changer in both our daily lives and the crypto ecosystem. Far from being a distant sci‑fi fantasy, these intelligent executors are already automating complex tasks — from managing job applications to executing seamless DeFi operations. As we stand on the brink of a new era in 2025, this article delves deep into the transformative potential of AI agents, exploring their functionality, the different types, and the investment opportunities they present in the blockchain space.

At their core, AI agents are the executors of artificial intelligence. While traditional AI (like ChatGPT) serves as the "brain" that processes and provides information, AI agents are the "hands" that transform that knowledge into actionable results. Imagine handing over your résumé to a bot that not only scans for the best job openings but also applies to multiple vacancies on your behalf — all automatically. This seamless transformation from thought to action is the essence of AI agents.

The integration of AI agents into the blockchain realm is creating unprecedented opportunities in the crypto market. With the global market cap for AI agent-related tokens hovering around $14 billion, these technologies are still in their infancy relative to giants like Bitcoin or Ethereum. Yet, their potential for growth is enormous.

Consider the scenario where an AI agent handles the entire process of converting Bitcoin to Ethereum and depositing it into your wallet using the most efficient decentralized platforms. This is not merely a hypothetical concept — it's already being developed and refined.

The video script outlines several types of AI agents, each targeting a different niche within the crypto ecosystem:

Tip for Readers: When evaluating these tokens, always perform in-depth research into tokenomics, utility, and market cap comparisons to distinguish between sustainable projects and speculative bubbles.

For those eager to dive deeper into this revolution, several platforms offer invaluable insights and data:

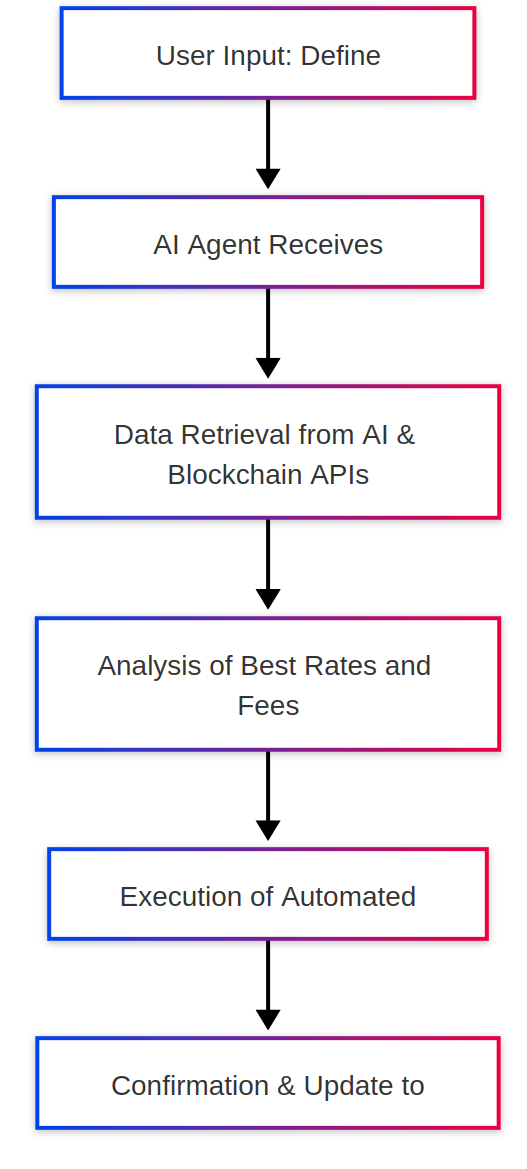

To demystify the process, consider the following flowchart that outlines how an AI agent can automate a DeFi transaction:

This simple diagram illustrates the process — from receiving the initial command to executing the transaction — highlighting the efficiency and precision of AI-driven automation.

While the promise of AI agents is undeniable, the landscape is complex and filled with both opportunities and risks. The video emphasizes a speculative approach in the early days:

The key takeaway is to adopt a cautious yet proactive approach. Engage in thorough research, consider short-term gains versus long-term viability, and always remain updated with the rapid innovations in this sector.

AI agents are not just an emerging trend — they represent a fundamental shift in how technology, finance, and daily tasks intertwine. As 2025 unfolds, their influence will likely redefine the crypto landscape, driving innovation and investment opportunities to new heights.

Are you ready to explore this brave new world? Which type of AI agent excites you the most — the high-octane influencer bots or the robust, long-term infrastructure projects? Share your thoughts and join the conversation in the comments below!

Berachain's Mainnet debut was, by many accounts, underwhelming. Priced around $8 at launch and slipping to the $5 range shortly afterward, the project has faced unrelenting FUD, a market in freefall, and an undercooked ecosystem. Even so, it's too early to call this an outright failure. Much of what Berachain promises — its high-yield DeFi ecosystem built on Proof of Liquidity — has yet to truly go live. Is there hope? Let's explore what went wrong, the controversy around the airdrop, and why this chain might still offer strong yields for savvy users.

Fact: Berachain launched around $8 and has since slipped toward the mid-single-digit mark, landing near the top 150 in market capitalization. While alarming, only a few days have passed. The chain's unique proposition — Proof of Liquidity — isn't yet fully operational. Early hype pegged Berachain tokens at $40, but current conditions clearly paint a different picture.

1. Market Crash for Altcoins

2. Extreme FUD

3. Ecosystem Not Ready

Multiple issues are fueling the negativity:

If developers had explained the locked tokens, staking APR, and phased ecosystem rollouts earlier, many misunderstandings could have been avoided.

This is the most intense wave of FUD witnessed in a project's early hours. Not just disgruntled airdrop participants — this wave included large Twitter and Instagram accounts attacking Berachain on launch day. Some criticisms had kernels of truth (like insufficient communication), while others were pure speculation (e.g., claims of a 20% APR for VC staked tokens). In reality, it's closer to 3%.

Impact:

One crucial misunderstanding revolved around the VC tokens. Yes, they have tokens locked for one year, followed by two years of linear vesting. However, locked tokens could still be staked, generating APR — a scenario leading many to believe VCs would aggressively dump large sums regularly.

With most tokens locked, big VC unlocks won't happen until month 12, followed by 24 months of gradual vesting. By clarifying this earlier, Berachain could've silenced much of the FUD.

A 15% slice of $BERA's total supply was earmarked for airdrops:

This was widely known within Berachain's NFT circles. Yet, many outside the loop perceived it as "insider favoritism." In truth, the B Bears were listed publicly on OpenSea for three years, accessible to anyone.

Countless watchers expected a big testnet airdrop. However, testnets rarely deliver huge token giveaways because:

Thus, some testnet participants who received zero or negligible $BERA felt shortchanged. From a dev standpoint, massive testnet airdrops are impractical.

Phase 0: "Network Skeleton"

Phase 1: Ecosystem Emergence

Phase 2: Decentralization & Maturity

Until Phase 1 hits its stride, Berachain remains incomplete. The real test is whether these dApps roll out in time to capitalize on renewed market interest.

Opinions are split:

Berachain's rocky start stands as a case study in how poor timing, deficient communication, and coordinated FUD can tank confidence in record time. But if you peel away the hype and negativity, two truths remain:

Actionable Takeaways

What do you think?

Share your opinions below. Engaging in open dialogue could shape whether Berachain emerges as a top yield strategy or just another altcoin cautionary tale.

Are you ready for Berachain's most pivotal week yet? With rumors swirling of a Mainnet release in less than seven days, the ecosystem's final countdown is in full swing. This moment is critical for anyone who's tested Berachain, holds NFT collections tied to its ecosystem, or simply wants to dive in right when the network goes live. This article distills the flurry of updates — from Boyco's jaw-dropping liquidity stats to Yeet and Beradrome's refined tokenomics, and even bridging your NFTs into Berachain. Whether you're a seasoned participant or just catching the buzz, these insights will prepare you for the monumental days ahead.

The million-dollar question is when Berachain will officially launch. At the time of recording (Saturday, February 1st), speculation suggests Mainnet could drop within a week. Key items to look for include:

Insight: Keep an eye on Boyco for real-time announcements; changes can happen overnight.

Boyco serves as the pre-launch liquidity engine, letting you deposit assets on Ethereum before they transition to Berachain's Mainnet. The objective? Ensure the chain starts with robust TVL (Total Value Locked). Here's the gist:

Note: Boyco has ended as of Sunday/Monday, but the overarching principle remains. If you participated, expect competitive yields and a portion of that 2% $BERA distribution.

Yeet's airdrop garnered significant buzz this week. Why? They've updated tokenomics for NFT holders, raising the allocation from 15% to 20%. Key highlights:

How many tokens do you get? Check with Yeet's Official Checker to see if you qualify. Or consult this spreadsheet for details. Some holders stand to receive 36k–40k tokens per NFT, translating to an easy four-figure sum if Yeet hits typical FDV ranges. It's all speculation, but the numbers look promising.

Beradrome's Airdrop & RFA Listing got a tweak: the share going to its NFT holders (the "Tour de Berance" collection) moved from 15% to 20% of total supply. That's major news for those "bear-on-a-bicycle" NFTs:

Pro Tip: This might influence NFT floor prices on marketplaces like OpenSea. Legendary items are fetching 7.5 ETH+ (over $24k).

Kingdomly introduces a user-friendly way to bridge NFTs from Arbitrum (or another chain) to Berachain. Ahead of Mainnet, they've launched a bridging quest so you can practice. Here's the process:

When Mainnet arrives, you'll apply the same steps to shift real NFTs onto Berachain — particularly crucial if you hold Arbitrum-based Kingdomly assets.

Beramonium — the fantasy-like game pegged to Berachain — recently concluded a snapshot for its upcoming token presale. Key points:

They also closed a 6.9% private round with multiple backers, reflecting healthy community interest.

Roots joined the trend by rolling out an RFA eligibility checker. If you tested their dApp or engaged deeply in certain tasks, you might get allocated $BERA from Berachain's official dev grants. Here's your plan:

Finally, keep tabs on:

Berachain's imminent launch weaves together massive liquidity events, booming NFT integrations, and potentially rewarding airdrops. Boyco has already cemented over $3B in assets. Yeet and Beradrome are refining tokenomics. Kingdomly solves NFT bridging. And games like Beramonium prepare presales. Whether you're a DeFi strategist or NFT collector, the window to claim a piece of Berachain's next chapter is almost closed.

Ready to level up your strategy?

Comment below with your thoughts:

Are you bridging NFTs? Stacking stablecoins for boiko? Let us know how you're positioning for launch — your feedback might guide someone else's winning strategy!

Good luck, and may Berachain's debut bring you abundant yields and unforgettable NFT gains!